Technology’s potential to transform the insurance industry remains unfulfilled, and it is high time to seize the advantages on offer

The insurance industry has to date been underserviced by the technology sector, particularly in Australia and New Zealand. Cloud-based systems offer enormous potential for brokers, underwriting agencies and insurers to cut out repetitive tasks and make operations vastly more efficient, ultimately improving business outcomes and the experience of the end customer.

That’s the message from Auckland-based JAVLN to the insurance community it serves.

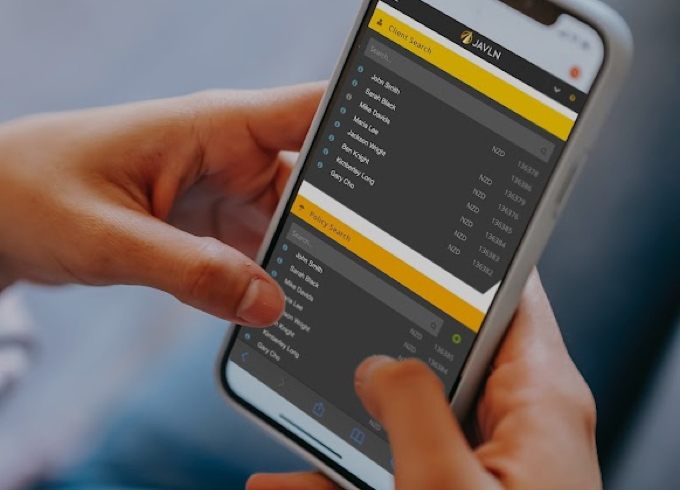

The company offers a secure cloud-based policy management platform accessible on any device, and has more than doubled its headcount in Australia to over 20 with the acquisition of Melbourne-based Technosoft Solutions (known as OfficeTech) and the Underwriter Central business from Steadfast.

It now has people based in Melbourne, Brisbane, Western Australia and Sydney.

Banking and other financial services have been transformed by technology, but insurance is lagging significantly and has monumental potential for digitalisation. It’s essential that the industry gets on board – or it will be left behind.

“You know, get on the bus – because we’ve got a great opportunity to make insurance better for ourselves in the industry, and for our customers,” JAVLN Chief Executive Dale Smith tells Insurance News.

“The potential for technology in the insurance industry is huge, enormous.”

It’s technology that will enable brokers, agencies and insurers to run better businesses and ultimately provide better outcomes.

“For example, compliance is just one process that can be automated by cloud technology, which not only feeds into a stronger industry, but gives brokers the time back in their day to build relationships with their customers, build their businesses, spend time with their families, or what have you.”

An accountant by background, Mr Smith says he is by nature an entrepreneur and has a passion for building businesses.

“That’s my strength, that’s what I’ve done for the last 20 years and I love it. I’m so motivated by the opportunity that we have to transform the way the insurance industry operates.”

Many intermediary firms are still “on premise” instead of the cloud and missing out on the advantages technology offers. Not just in the automation of compliance, but in other fields such as document and claim management, and data source connectivity.

When brokers spend less time on processes, they can spend more time growing their businesses and servicing clients, he says.

“The insurance industry, in particular in our region of the world, has been underserviced from a technology perspective. At the same time, the risk landscape that Australians face is increasingly complex, meaning the role of a broker is more important than ever, and brokers need the right tools to do their jobs effectively and accurately.”

“JAVLN is cloud native, we’re modern, easy to use and to understand,” Mr Smith said. “You can use our application from any device anywhere, anytime.

“There are huge benefits that modern technology can provide to insurance businesses, whether you’re an agency or a broker. We help with compliance, automating manual and repetitive tasks, and with providing customers great online experiences.

“We integrate to other platforms. With a modern platform like JAVLN, you get the ability to unlock huge amounts of value, so brokers can actually spend more time with their customers.

“It can often feel daunting so by engaging with us, we’ll take brokers through a really nice, easy to understand process.”

JAVLN can also help track key performance metrics like premium growth, retention rate, new business acquisition, average policy size, loss ratio, and a tonne more, to help clients make informed strategic decisions.

Founded in 2011, Mr Smith says JAVLN offers a “safe pair of hands” for insurance professionals, which by nature are usually conservative and “think about risk all day every day”.

“Over the years, I’ve thought that there’s a great opportunity for us to make this experience better. We’re only part-way through that journey at the moment but we’re on the right track, that’s for sure.”

This article was originally published by Insurance News.

Related Articles

-

With a strong instinct for innovation, JAVLN CEO Dale Smith is intent on revolutionising insurance industry technology. When Dale Smith was a teenager, he had no specific aptitude for any…Read more

With a strong instinct for innovation, JAVLN CEO Dale Smith is intent on revolutionising insurance industry technology. When Dale Smith was a teenager, he had no specific aptitude for any…Read more -

Brokers “still grappling” with outdated technology

Brokers, with justification, often express dissatisfaction with some insurers’ clunky, outdated computer systems. However, JAVLN, an Australasian insurtech, says brokers should look at their own legacy computer platforms. A media…Read more -

How insurance companies can break ‘bad digitisation’

Digital technologies present huge value to insurers and their customers. New systems can transform pricing, distribution, underwriting and claims processes. They can provide easy access to rich data that enhances…Read more