With a strong instinct for innovation, JAVLN CEO Dale Smith is intent on revolutionising insurance industry technology.

When Dale Smith was a teenager, he had no specific aptitude for any one subject. However, he knew how to work hard and he knew he wanted to do something entrepreneurial. “That’s a strength that I’m proud of. Hard work has carried me through not only my schooling and university, but also into my career,” he says.

“Also, my father gave me some good advice early on. He said, get a good grounding in numbers and that will set you up.”

Smith did just that, completing a degree in accounting and finance at Unitec Institute of Technology in Auckland, as well as a graduate diploma of chartered accounting at Chartered Accountants Australia and New Zealand. He then worked for five years in an accounting firm.

“I enjoyed the customer engagement side and was good at bringing clients into the firm, but I knew pretty early on compliance work and financial statements were not for me,” he says.

Going solo

At the age of 25, Smith took the plunge and purchased his first company, DTC, a transport and logistics business. “I had to put everything on the line for that but ended up selling it profitably in 2007, just before the GFC,” he says. “That was good luck rather than good management I think, but, in hindsight, great timing.” After waiting out the recession, Smith purchased his second business — one that put him on the road to becoming a tech entrepreneur.

“It was an import distribution company called Connector Systems,” he says. “When I sold it, the buyers didn’t want the software side of the business, so I kept it and that’s where JAVLN began.”

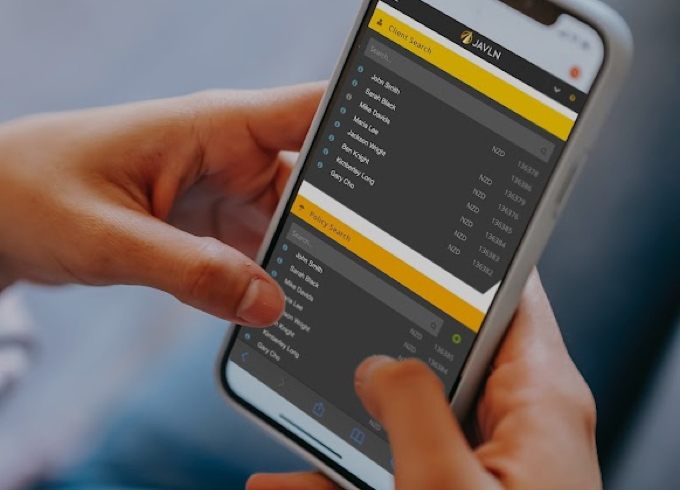

Twelve years later, JAVLN is an innovative cloud-based software company that offers an insurance policy and client management platform for brokers and underwriters. Designed to improve compliance and workflow and to automate repetitive tasks, it has grown from five to 120 staff located in Auckland and Melbourne.

“There is a lot of pressure on insurance companies caused by anything from natural disasters to dealing with big issues such as cybersecurity and liabilities. The role that insurance plays is very important.”

Insurance’s Achilles heel

Smith thinks the insurance industry as a whole receives a lot of bad press.

“It doesn’t get enough credit for what it provides,” he says. “Businesses work hard to create asset value, and that has to be protected. There is a lot of pressure on insurance companies caused by anything from natural disasters to dealing with big issues such as cybersecurity and liabilities. The role that insurance plays is very important.”

But, adds Smith, technology is letting the Australasian insurance industry down, with widely used software that is outdated, inflexible and inefficient. “In the intermediary space, such as in technology, the dominant legacy software vendors are not innovating at the pace the industry needs, and they are taking their customers for granted.” He says it’s time that changed.

Getting smarter with data

Insurance is all about data, says Smith — “and modern technology offers the ability to easily consume structured data from other sources on the internet.”

Conversely, he says, legacy software relies on the user manually keying information into their old systems, which is “just ripe for human error”.

Smith says JAVLN has developed innovative and easy-to-use software that increases compliance by guiding the broker through certain steps. “You can’t place a policy with an insurer until you have given the client the necessary information,” he explains.

To address privacy concerns, the company has partnered with Amazon Web Services, “the best and most reliable cloud technology in the world, and we have made sure our systems are bulletproof”.

The platform can manage different tax regimes and currencies. “We built it like that from the ground up. We have customers in New Zealand, Australia, Pacific countries, and we’ve even got some customers in Guam, which illustrates it can be used in other geographies.”

Most importantly, Smith says the technology enables brokers to stay on top of industry trends in an increasingly complex landscape.

“Through our innovations, we’ve proved that our customers can increase productivity, take on more clients with the same number of brokers and enable them to grow their customer base.”

Eye on the competition

To keep ahead of the curve, Smith says JAVLN “invests a lot of time in large technology partners to understand trends and what’s coming through”.

The company also keeps a close eye on what competitors and the broader industry are doing, as well as garnering feedback from customers to improve its product.

“We have a very large commercial opportunity to take our software further and so all our strategies hang off that,” says Smith. “Whether that’s about people, product or technology, we are unlocking that opportunity to sell JAVLN to as many brokers and underwriting agencies as possible.”

No slowing down

In addition to organic business growth, Smith has acquired two Australian companies, to bolster JAVLN’s technology and support team and build a stronger Australian presence. These include Underwriter Central, an underwriting policy management platform provider for agencies, and OfficeTech, a document management platform provider. He also has his sights set on Asia, the United Kingdom and, all going well, the United States.

“We’re innovating every day with everything we do, to be honest,” he says. “It’s an exciting space to be part of. And, we’d like to take JAVLN public in about two years.”

For the man who says providing for his family is his number-one driving force, the longer-term future is just as exciting.

“I have three boys, tremendous young Kiwis who are going to be the next generation of innovators.”

This article was originally published in the ANZIIF Journal, V46, Issue 4.

Related Articles

-

By Dale Smith, CEO JAVLN. The recent federal budget probably left many small businesses across Australia banging their collective heads against a brick wall. While a few tweaks to the…Read more

By Dale Smith, CEO JAVLN. The recent federal budget probably left many small businesses across Australia banging their collective heads against a brick wall. While a few tweaks to the…Read more -

3 tips for insurance brokers tackling compliance in 2024

By Dale Smith, CEO JAVLN The Australian insurance industry has found itself in an interesting position in 2024. After a few years of intense storms, cyclones, flooding and bushfires, more…Read more -

Brokers “still grappling” with outdated technology

Brokers, with justification, often express dissatisfaction with some insurers’ clunky, outdated computer systems. However, JAVLN, an Australasian insurtech, says brokers should look at their own legacy computer platforms. A media…Read more