Become a tech-focused underwriting agency

Agencies have only begun to explore the many potential applications of technology in their businesses. That’s why we’re continuously developing a software platform to meet the needs of their industry.

Book a Demo

The role of technology within agencies has grown

To optimise the use of technology in specialist underwriting agencies, it is important to automate processes, reduce duplication, use data to provide risk insights, meet compliance requirements, and showcase products and service excellence to brokers. Cloud-based software has become increasingly popular and can help agencies achieve these goals.

Specialist underwriting agencies are an alternative source of capacity and have the expertise to arrange cover for unique risks that mainstream insurers can’t. The role of technology in these agencies has seen steady growth, and JAVLN’s technology is responding to these needs by enabling agencies to completely digitise processes from end-to-end.

JAVLN’s modern and scalable policy platform provides core functionality and offers a range of extensions for bespoke solutions if needed. By leveraging technology, specialist underwriting agencies can improve their operational efficiency and provide better service to brokers while meeting their regulatory obligations.

-

Retain employees

Great software helps improve employee satisfaction by providing them the best tools to do the job.

-

Handle compliance

A modern software platform provides functionality & features designed to assist with compliance.

-

Reduce costs

Software as a Service (SaaS) reduces the total cost of ownership for your software infrastructure.

-

Broker Management

Broker ManagementStay Connected

Gain a holistic view of your agents, brokers and insurance partners by capturing in-depth information about your business relationships. Connect with people and showcase value to agents and brokers.

-

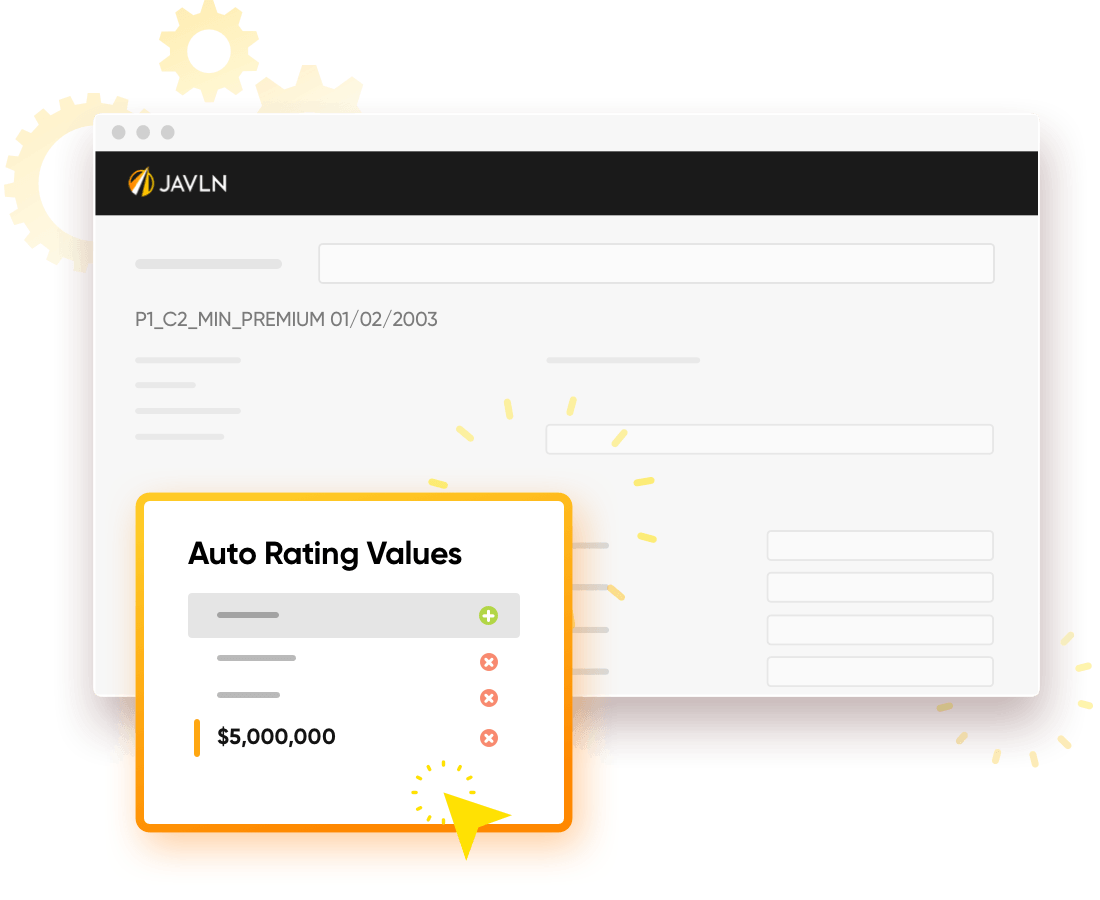

Underwriting

UnderwritingManage Binders

Simple or complex binders are managed within the platform, with version controls, and can be updated in real-time in response to the evolving risk landscape.

-

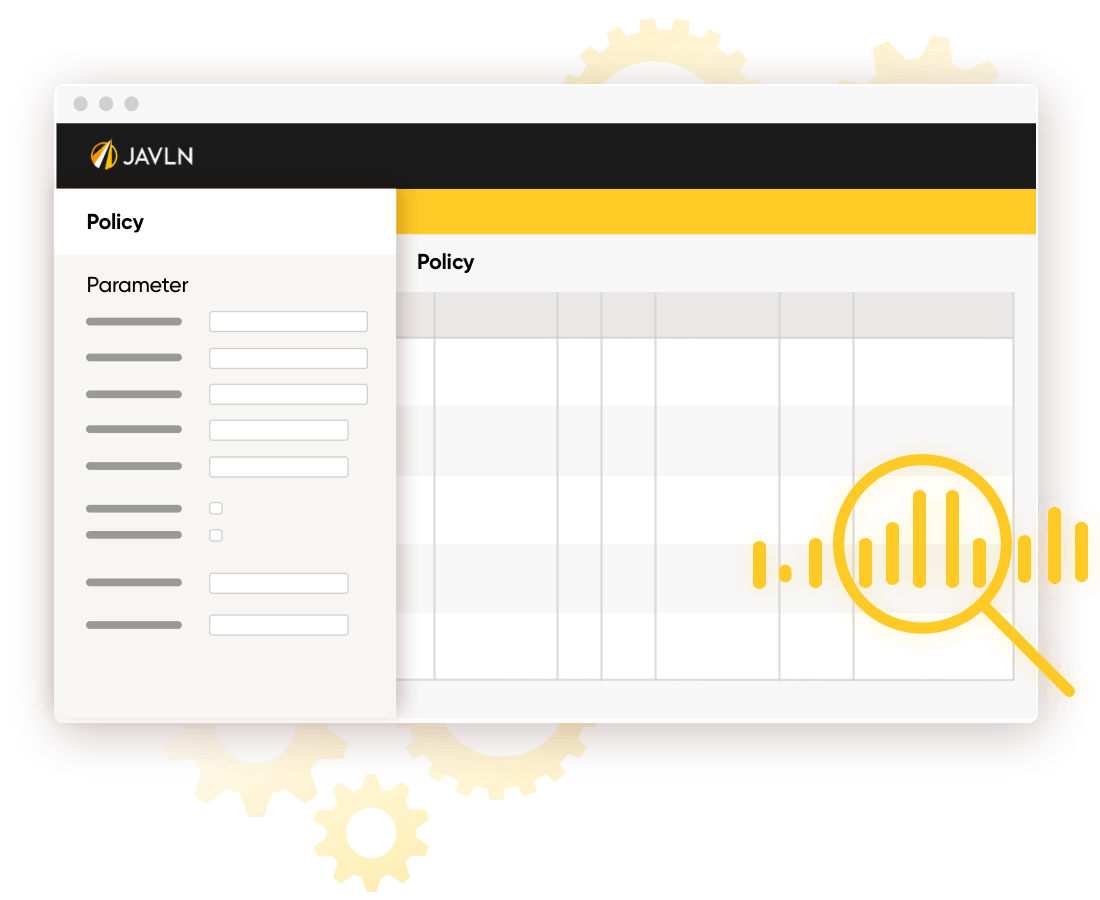

Reporting

ReportingBordereaux

The policy platform captures all risk information, structuring the data in a way that can accommodate the reporting demands of both insurers and reinsurers. A wide range of reports are available out of the box or can be easily customised.

Case Study

Global Underwriting

“Our ‘Bordereaux’ reports to Lloyds previously took 3-5 days to complete, but can now be produced in JAVLN in an hour. ”

Global Underwriting, based in Victoria, Australia, was established by Alan Wilson Insurance Brokers to focus on servicing brokers who predominantly offer fire protection cover.

Global Underwriting searched for a policy management platform designed for underwriting and the reporting requirements of its Lloyds coverholder. Before meeting JAVLN, the agency had been using AWIB’s software which is more suited to the needs of brokers and required double data entry.

“Manually doing our reporting on the existing platform was taking days,” says Kim Brew, Director & Branch Manager at Alan Wilson Insurance Brokers. “We knew it must be possible to improve both the efficiency and user experience, and have found that on JAVLN’s centralised interface,” she says.

“Onboarding was straightforward and JAVLN’s team continue to help us learn how to maximise the potential of a cloud-based platform.”

Going live in May 2022, Global Underwriters has eliminated many repetitive manual processes, resulting in a significant rise in productivity and staff satisfaction.

Kim says the ability to customise JAVLN allows her team to create specific reports to suit clients, without additional costs.

“We can now provide distinct data to Lloyds in the format they prefer, which has enabled us to increase our capacity for new business.”

-

We grow with youJAVLN’s policy platform portals & extensions are designed to allow customers to realise opportunities and solve complex problems. Designed with the needs of industry in mind and developed in-house they allow the features of our software to quickly evolve.Portals & Extensions

-

You’re supportedWell trained consultants and support teams build close relationships with customers. They ensure both seamless onboarding and that users get the best out of the platform. We provide a range of support plans to meet the needs of customers so help is always on hand.Onboarding & Support