By Dale Smith, CEO JAVLN

The Australian insurance industry has found itself in an interesting position in 2024.

After a few years of intense storms, cyclones, flooding and bushfires, more and more people and businesses across the country have found themselves in desperate need of adequate insurance. But at the same time, these people and businesses have been facing a cost-of-living squeeze, which means they’re after the best possible premium price, without compromising on cover.

That combination of natural disasters and tightening of belts has made insurance brokers an incredibly popular proposition right now over going direct to insurers. Brokers are there to understand exactly what their clients need, determine where they need cover, and fight their battles for them in the complex insurance world.

As such, I’d always advise people to use brokers wherever possible. Brokers are the heroes that Australians need right now. But they’re hampered by a massive problem at the moment, which is draining their time, brain power and sanity.

That problem is compliance.

Why compliance is a big problem for insurance brokers right now

The crippling requirements of insurance compliance seem to multiply exponentially the more clients a broker takes on. I feel especially for new brokers entering the industry who may be experiencing this for the first time. There are so many tiny things to remember that it’s difficult to adhere to the right requirements while also giving your clients the time and attention they rightly deserve.

In JAVLN’s recent Brokering Change report, a third (33%) of insurance brokers say that compliance is one of the most burdensome activities they work on as part of their day-to-day job. 20% go as far as to say that managing compliance workloads will be among the top hurdles they’ll face in 2024.

This huge focus on compliance is taking a significant toll on productivity. The increasing demands to comply with complex and changing regulations is diverting time away from revenue-generating tasks that drive business growth for insurance brokers.

Of course, adhering to compliance and staying up to date with the latest regulations is crucial for insurance brokers. The last thing anybody needs is a compliance spanner in the works, and policyholders need to be protected at all times. But how can we as an industry make it easier for ourselves to adhere to compliance and give our clients the best possible service?

Here are my top three tips.

1. Make your compliance obligations clear and accessible

This sounds like an obvious one, but it’s worth mentioning because of how important compliance is. Broking firms and underwriting agencies must clearly identify the obligations that apply to their company and align those with how they provide their services. It’s important that these obligations are recorded and incorporated in a risk and compliance manual for staff to refer to.

Often insurance brokers are caught up in the day-to-day tasks of their role, servicing clients and completing admin tasks, so insurance regulations don’t come top of mind when they need them. Making sure that your risk and compliance manual is easily accessible and simple to refer to will make it easier for insurance brokers to meet their requirements.

2. Keep track of all compliance issues

The last thing anybody needs in a compliance situation is a poorly kept paper trail. Train your people on a systemic approach to compliance, and outline their responsibilities around identifying and reporting incidents, breaches and complaints. The organisation should then keep track of all compliance reports and regularly analyse the data to make improvements to the compliance process or to report breaches to regulators or code committees.

I’d also advise that organisations keep an eye out for any third-party information to mitigate the compliance risk. Look out for regulatory reviews, ASIC letters, court cases, regulator speeches and media releases, and ask yourself the question: ‘could this happen to us?’ or ‘how might we deal with this?’

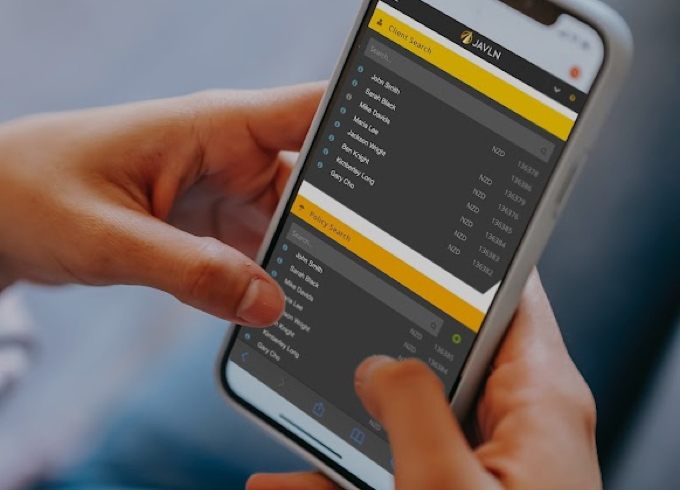

3. Let technology take care of the grunt work

What adds to the stress of meeting these countless compliance requirements is brokers having to adhere to fiddly compliance controls in the moment because the outdated client and policy management tech they’re using can’t do it automatically. In fact, so bad is the current state of technology in Australian broking firms and underwriting agencies that 23% of brokers say that it’s not fit for purpose any more.

And you can’t blame them for feeling that way. 27% of brokers say the technology they use to manage clients and policy information is too confusing. 20% of brokers say they spend far too much time inputting client and policy data into platforms. And just 23% of brokers say they don’t have the tools they need to be as productive as they possibly can be.

Brokers are in desperate need of new technology that enables them to easily adhere to compliance in the moment. With the right technology in place, everybody wins. The broker has more time to spend on clients and sourcing adequate cover, while the broking firm gives productivity a shot in the arm, leading to an envious ability to take on more clients without needing more resources.

One such broking firm in Australia that has embraced new technology is Trans-West Insurance Brokers. Before upgrading its tech platform, the firm had to ensure compliance by manually capturing the right client information, saving documents in the right place, notifying the client with specific updates, and much more. As such, compliance was never too far from Trans-West’s brokers’ minds at every step of the insurance brokering process.

After upgrading its tech platform, however, Trans-West’s brokers have been able to put compliance out of their minds because the technology takes care of requirements like time-stamping, highlighting mandatory fields within specific workflows, and integrating client correspondence. And as a firm, new technology is helping to demonstrate compliance easily to customers and regulators, reduce professional indemnity exposure, and maintain its reputation as a client-centric organisation.

So compliance doesn’t need to be a broker problem. Let the tech take care of it so you can focus on what matters.

This article was originally published on Australian Fintech.

Related Articles

-

By Dale Smith, CEO JAVLN. The recent federal budget probably left many small businesses across Australia banging their collective heads against a brick wall. While a few tweaks to the…Read more

By Dale Smith, CEO JAVLN. The recent federal budget probably left many small businesses across Australia banging their collective heads against a brick wall. While a few tweaks to the…Read more -

Dale Smith – Challenge Accepted

With a strong instinct for innovation, JAVLN CEO Dale Smith is intent on revolutionising insurance industry technology. When Dale Smith was a teenager, he had no specific aptitude for any…Read more -

Brokers “still grappling” with outdated technology

Brokers, with justification, often express dissatisfaction with some insurers’ clunky, outdated computer systems. However, JAVLN, an Australasian insurtech, says brokers should look at their own legacy computer platforms. A media…Read more