The latest technology can allow brokerages to take on more clients with the same number of brokers and resources, insurtech JAVLN and client Trans-West Insurance Brokers say, boosting productivity and enabling businesses to grow footprints, sell more insurance and improve profitability.

At a presentation at the NIBA Convention at The Star Gold Coast last week, Trans-West told attendees JAVLN has been a “game changer for our brokerage”. GM Pieter Versluis says earnings per full-time staff member have increased by 8% since adopting JAVLN’s all-in-one platform, and there has been a 20% improvement to productivity.

“That has been one of the biggest wins for us,” he said. “It has directly improved our bottom line.”

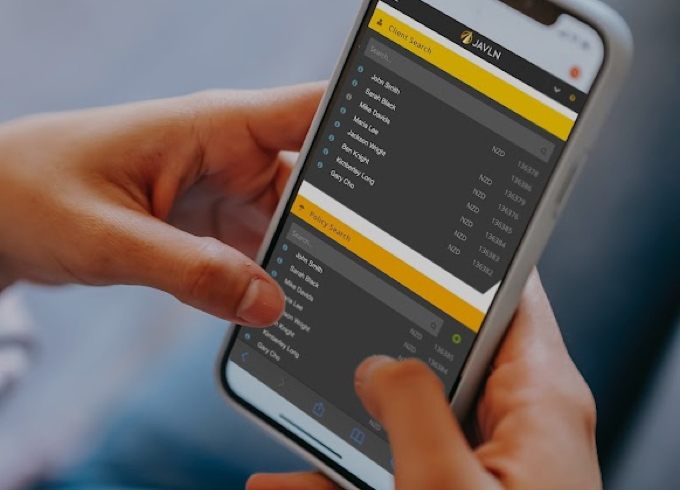

New Zealand-based JAVLN offers a secure cloud-based policy management platform accessible on any device. The insurtech is headquartered in Auckland and has IT staff in Melbourne and Brisbane.

Earlier this year it acquired the Underwriter Central business from Steadfast.

“Its user-friendly interface and client-centric approach have significantly improved our efficiency and enabled us to take our customer service to the next level,” Mr Versluis said. “The continuous development and support from the JAVLN team has made this partnership invaluable.”

The brokerage had been struggling with a fragmented system that “made it incredibly difficult to get a full picture of our clients”. Information was siloed in different locations, and there was no consistency in how client data was recorded.

Brokers had to manually upload policyholders’ details, email trails, call records and other information into numerous databases, which was time consuming and introduced duplication and errors.

“Keeping all of our files and communications organised and updating information across multiple systems was an onerous task. These challenges made it nearly impossible to provide the integrated client service we strive for,” he said.

JAVLN was tasked with resolving an inefficient allocation of time spent by brokers who found themselves often wrangling with antiquated technology at the expense of helping customers and selling policies.

Trans-West also wanted to resolve disparate sources of information, inconsistent data and manual processes. That created a complex workday for brokers – onboarding new employees took time and effort, tracking down policyholder details was too complex.

“Trans-West’s brokers were missing opportunities to renew existing policies in a timely manner, upsell further policies and maintain customer satisfaction,” the pair say.

Another goal was to help with compliance as brokers had been burdened with manually capturing the right client information, saving documents in the right place, notifying the client with specific updates, and more. JAVLN says it takes care of compliance through time-stamping, highlighting mandatory fields, and integrating client correspondence.

It helped Trans-West centralise all policyholder details, communications, policies, renewal dates and other key data in one place, and this helped the company to go almost completely paperless.

“The move caused very little disruption to our day-to-day operations, and the intuitive and user-friendly interface enabled our staff to get up to speed within just a week of training,” Operations Manager Sandra Barrett said.

“JAVLN has made a huge difference to our ability to audit ourselves and demonstrate compliance. That really helps us at a management level for our compliance and breach reporting requirements.”

This article was originally published by Insurance News.

Related Articles

-

The JAVLN Board has appointed David Leach as the new CEO, from Monday 14 October 2024. David will succeed JAVLN Founder and current CEO, Dale Smith, as he assumes the…Read more

The JAVLN Board has appointed David Leach as the new CEO, from Monday 14 October 2024. David will succeed JAVLN Founder and current CEO, Dale Smith, as he assumes the…Read more -

OfficeTech by JAVLN announces refreshed brand and software integration

JAVLN, the cloud-based insurance policy management platform, has announced the next stage of its 2023 acquisition of Technosoft Solutions’ document management and workflow software. The well-known Officetech suite of products,…Read more -

Data blindness ‘leaves brokers in dark’

A lack of access to clear client data is holding brokers back and making sales and customer policy management less efficient, insurtech JAVLN says. CEO Dale Smith told insuranceNEWS.com.au insured…Read more