Ask Dale Smith to interpret what unique differentiation means in a crowded market and his reply will be explicit – “this is about focus”.

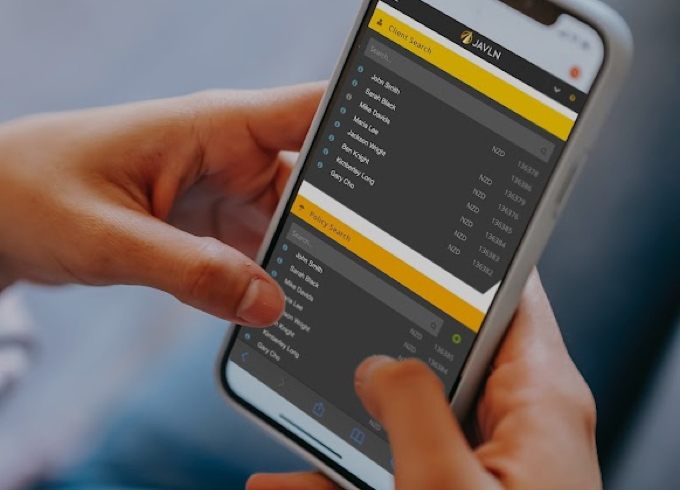

There’s no swaying in the wind at JAVLN, a cloud-based insurance policy management platform born in Auckland. This is a CEO and a company on a clear mission for growth armed with two core priorities.

“Insurance and this region,” Smith noted. “We are 100% focused on building a software-as-a-service [SaaS] insurance platform to meet Australian and New Zealand broker and underwriter needs. This means we can innovate and iterate in insurance-specific processes faster than a global firm which addresses multiple industries.”

Established in 2014, the business operates across the entire insurance value chain and goes to market as a certified technology partner of Amazon Web Services (AWS) – housing 75 employees across Auckland, Melbourne and Brisbane.

“Our top strategic priorities during the next 6-12 months are expanding in Australia, potential acquisitions and attracting and retaining talented people,” Smith said.

“Our biggest opportunity is building our brand recognition, especially within Australia. We have had a presence in Australia for some time but in 2023 will accelerate this both organically and through acquisition. This will be supported with new products for independently owned brokers.”

The business raised A$6.7 million to support growth plans in July 2022, following a partnership with Australian pre-IPO fund manager Bombora. The raise included a private offer to pre-IPO investors which was up-sized from $3.25 million to $4 million.

In becoming one of the first New Zealand-domiciled start ups to access the Australian pre-IPO market as a precursor to a future ASX listing, JAVLN is already putting the new capital to work with plans to accelerate expansion across the Tasman. Wider reach into Asia Pacific will soon follow as the company embarks on a significant period of organic growth and acquisition.

Namely, the purchase of Underwriter Central and Insurance Connect businesses from Melbourne-based Steadfast Group in June.

Designed to bolster Australian technical consulting and support capabilities, JAVLN will continue to support both Steadfast owned and independent underwriting agencies using Underwriter Central, while providing a pathway for customers to migrate.

“I am excited to welcome the Underwriter Central team to JAVLN and look forward to working with them to support Underwriter Central clients to grow their businesses,” JAVLN said. “Integrating Underwriter Central into JAVLN will increase our scale and ability to partner with other clients in Australia.”

The buyout follows the acquisition of JRNY’s AI-driven customer experience software in October 2021. The move enabled brokers and insurers using JAVLN to gain a more intuitive experience by leveraging AI-driven dynamic conversations, smart recommendations and data driven insights.

“My advice to fellow entrepreneurs seeking to build a specialist technology business is to be clear on what outcomes you want to achieve and effectively communicate this to both internal and external audiences,” Smith advised.

“Building JAVLN to be where it is today ranks as the biggest achievement but accessing growth capital was equally the biggest challenge.”

Insurance adopts innovation agenda

Privately funded until the capital raise, JAVLN is also priming to capitalise on “significant digital transformation” taking place within the insurance industry. Providers – including underwriters and brokers – face new reporting regulations in addition to raised customer and staff expectations for user-friendly online experiences.

“Innovation is even more important in this environment because automation and data-driven services reduce cost throughout the insurance value chain,” Smith outlined. “This means consumers gain greater visibility into the costs of policies and can make informed decisions about their cover.

“Brokers and underwriters increasingly see SaaS platforms as a way to reduce the back-end administrative and compliance costs of managing policies, while improving transaction times.”

In looking ahead, Smith said the insurance market is prioritising the deployment of data integration, process automation and generative artificial intelligence (AI) technologies to process claims more efficiently.

“Insurance organisations face greater regulation in how they relate to customers and they need to efficiently demonstrate that they comply with those requirements,” Smith added. “They are also using technology to address workforce challenges and meet changing consumer expectations around their online experience.”

Growth is also supported by the addition of key personnel, namely Matt Sealy as Chief Product Officer and Peter Zhang as Chief Technology Officer.

Sealy brings more than 15 years of enterprise product design and SaaS expertise to the company having previously served as Head of Product at MYOB, running enterprise resource planning (ERP) product lines and spearheading the launch and growth of MYOB Advanced.

“Matt has deep experience in leading product and design teams and a compelling track record of growing SaaS products,” Smith added. “Matt’s knowledge and product expertise will complement our growing leadership team as we expand into new markets.”

Prior to Sealy joining the business in January, Zhang was recruited in August 2022 having worked on the JAVLN since early 2015.

“As a business we both employ people with insurance domain expertise and also partner with specialists in certain parts of the value chain, such as payments,” Smith said. “As we grow there is also the option to acquire skills and IP because our biggest challenge is attracting and retaining the very best insurance domain talent available.”

This article was originally published by Moxie Insights.

Related Articles

-

By Dale Smith, CEO JAVLN Data has been the lifeblood of modern businesses across the world for the past 20 years. It’s helped transform entire industries, from agriculture to banking,…Read more

By Dale Smith, CEO JAVLN Data has been the lifeblood of modern businesses across the world for the past 20 years. It’s helped transform entire industries, from agriculture to banking,…Read more -

Why technology is making insurance brokers more valuable than ever

By Dale Smith, CEO JAVLN. The recent federal budget probably left many small businesses across Australia banging their collective heads against a brick wall. While a few tweaks to the…Read more -

Customer service has become a broker’s number one challenge

By Dale Smith, CEO, JAVLN Insurance brokers in Australia are at the coalface of a changing world. On the one hand, natural disasters up and down the country are becoming…Read more