Remarketing policies can be a complex process for insurance brokers, requiring a delicate balance between responsiveness and attention to detail – especially in a “difficult” insurance environment. Read on to learn valuable tips to enhance your policy remarketing process, to improve client relationships and operational efficiency. JAVLN’s policy platform simplifies these tasks.

1) Embrace a Seamless Transaction System

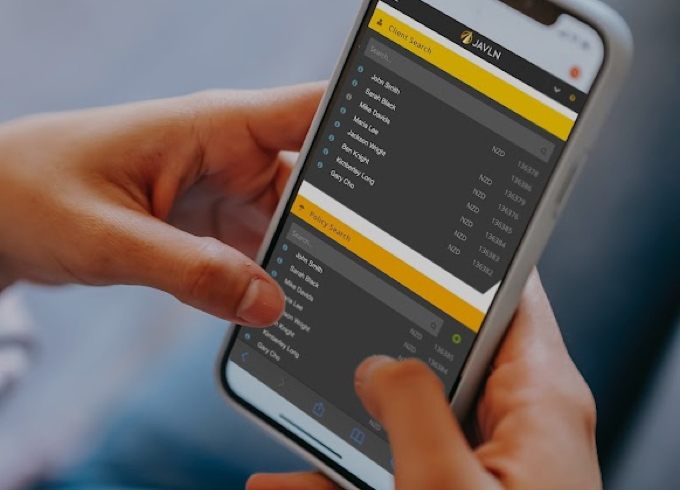

To meet clients’ needs promptly, it’s essential to have a robust system that enables transaction processing from anywhere. Using cloud-based solutions means accessing critical information from anywhere to respond quickly to client requests, enhancing their experience and overall customer satisfaction.

2) Maintain Accurate and Centralised Client Data

Ensure your clients’ details are accurate, up-to-date, and securely stored in a centralised system. – Centralisation enables easy generation of transactions, streamlined document and report management, and improves overall data integrity. JAVLN’s platform has a secure repository for storing client information, ensuring efficient access and utilisation.

3) Integrate with Underwriters’ Platforms and Data Sources

Reduce data entry time and enhance risk assessment accuracy by integrating your system with underwriters’ platforms and other relevant data sources. This integration empowers you with the necessary risk information to process quotes swiftly and efficiently. JAVLN’s platform offers seamless integration capability, eliminating the need for duplicate data entry and enhancing processes.

4) Provide Clear and Concise Comparison Documents

Simplify the buying process for clients by offering easy-to-read comparison documents. Transparency reduces friction and empowers clients to make informed decisions. JAVLN includes intuitive features and the creation of smart comparison documents, enhancing the overall customer experience

5) Manage the Entire Policy Lifecycle in One Platform

Save time and effort by utilising a comprehensive policy platform that allows you to manage the entire policy lifecycle in one place. Eliminating the need for double data entry and leveraging automation features, allowing focus on building and nurturing client relationships. JAVLN streamlines administrative tasks, freeing up valuable resources for client engagement and business growth.

Efficiently remarketing policies requires responsiveness and attention to detail. By implementing a cloud based solution like JAVLN’s policy platform, insurance brokers can significantly improve client relationships and operational efficiencies.

Discover how JAVLN’s platform can revolutionise your policy remarketing process today.

Explore JAVLN’s policy platform and the wide range of features designed specifically for insurance brokers.

Related Articles

-

By Kathryn McClunie, BDM. Hardly a day goes by without talking to an insurance broker looking for a Customer Relationship Management (CRM) solution. Surprisingly, when I ask brokers what they…Read more

By Kathryn McClunie, BDM. Hardly a day goes by without talking to an insurance broker looking for a Customer Relationship Management (CRM) solution. Surprisingly, when I ask brokers what they…Read more -

How one Australian brokerage saw a 20% improvement to productivity and an 8% increase in average revenue with JAVLN

Founded in 1975, Trans-West Insurance Brokers (Trans-West) is an Australian-owned and licensed general insurance brokerage firm serving commercial and industrial clients. Much of the company’s success over the past 45…Read more -

Maximising Performance: KPIs for Insurance Brokers and Underwriting Agencies

In the highly competitive landscape of insurance, brokers and underwriting agencies strive to optimise their operational efficiency. Monitoring Key Performance Indicators (KPIs) play a pivotal role in achieving objectives. By…Read more