BJS Insurance Group has adopted JAVLN’s client and policy management technology to boost broker productivity and data-driven decision-making.

The companies say the change allows BJS to manage client portfolios, policies and claims on one centralised platform, saving time and maintenance of outdated servers. It aims to bolster productivity, reduce operational inefficiencies and enable the BJS team to better use data to make informed decisions.

A three-year strategic partnership will see JAVLN roll out a full-service implementation, with an official “go-live” scheduled for mid-2024.

“The team are really excited, they’ve seen how the JAVLN system works and they’d all like to jump onto it today, but we’re customising it and it’ll be a roll-out over several months,” BJS CEO and owner Belinda Scott tells insuranceNEWS.com.au.

As BJS expanded to more than 170 staff in 13 offices nationally, the existing software platform was limiting insights into clients and policies and contributing to inefficiency across the business. The partnership with JAVLN will be a significant step forward, she says.

“The innovative platform addresses a range of pain points and is easily adaptable for our evolving needs,” says Ms Scott, who first saw the JAVLN system five years ago and looked at all systems on the market.

“For us it was just a no brainer, JAVLN really fitted everything we needed. It is the latest technology and extremely adaptable, you can bring other systems and programs in where they integrate.”

A big draw card was saving time by not having to reenter data on several different platforms. That allows the BJS team to “be outside clients and be brokers again, rather than stuck behind systems where they have to rekey and reenter” which is time consuming and can lead to errors.

“We’ve had such a lot of change in our industry. As a broker, we’re dealing with more insurers and underwriters than ever before and that means that we were using so many varied platforms, and having to rekey far more – it takes away from your time with the client and being effective. It isn’t the fun part of our job, rekeying data.”

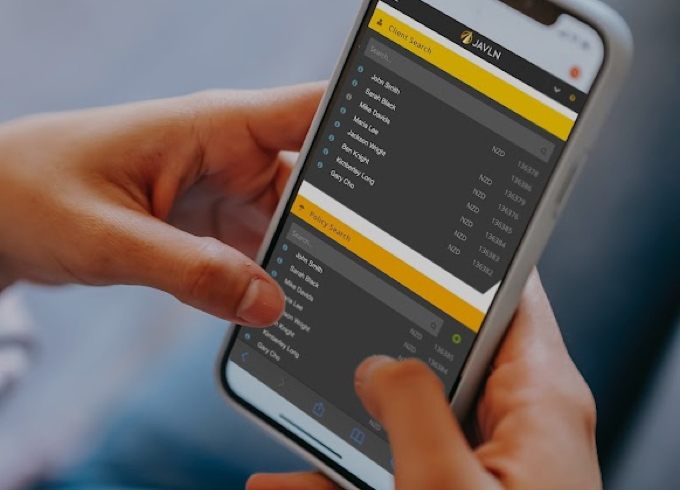

New Zealand-based JAVLN offers a secure cloud-based policy management platform accessible on any device. The insurtech is headquartered in Auckland and has IT staff in Melbourne and Brisbane. It recently acquired the Underwriter Central business from Steadfast, and Technosoft Solutions’ document management and workflow software OfficeTech.

Founded in 2011, the cloud-based platform is designed specifically for insurers, agents, underwriters and brokers.

Trans-West Insurance Brokers has also teamed with the insurtech and JAVLN says its technology now underpins operations at a growing number of brokerages throughout Australia, and it has local teams in most states.

CEO Dale Smith says brokers and underwriters have long been underserved by policy management software.

“Our innovative platform supports brokers like BJS who are forward-thinking and see technology as an enabler for their business,” he said. “This partnership is a ringing endorsement of JAVLN’s capabilities, innovation, and trusted reputation in the market, and a testament to the benefits we deliver: boosting brokers’ bottom line through productivity and efficiency gains, and client satisfaction.”

Another draw for BJS was gaining insights from the centralised system.

“To really be able to understand our business better and get amazing reporting on all the information that we do capture. The current systems are quite limited,” Ms Scott said, adding that JAVLN had been “really, really good to deal with”.

“They know brokers, they understand brokers and they’re customising it to work for us. So that’s perfect,” she said.

This article was originally published in Insurance News.

Related Articles

-

Insurance Business Australia has released its 2024 global 5-star technology and software providers list, and JAVLN has been featured for the third year in a row. To select the top…Read more

Insurance Business Australia has released its 2024 global 5-star technology and software providers list, and JAVLN has been featured for the third year in a row. To select the top…Read more -

JAVLN appoints tech leader David Leach to board of directors

JAVLN, the company that’s bringing insurance technology into the 21st century for insurance brokers and underwriting agencies, today announces the appointment of tech veteran and software leader David Leach to…Read more -

JAVLN bolsters leadership team to power the future of insurance

JAVLN, the company bringing insurance technology into the 21st century for underwriting agencies and insurance brokers, today announces the strategic appointments of Rosalie Lau as Group Chief Financial Officer and…Read more